Is One Measure of Engagement Sufficient? The Member Engagement Matrix

Part Two of the Member Engagement Series

Dr. Katie Swanson, VP of Consumer Insight, Member Intelligence Group

Ensuring that members remain engaged and loyal is an ongoing challenge for credit unions. Continuing on the reported results in the white paper, “Why credit unions should care about member effort scores: Development of the Net Effort Score,” this second of three white papers in the Engagement series addresses these challenges faced by credit unions.

This white paper has three main objectives:

1) Provide background knowledge on types of loyalty and measures utilized by credit unions to gauge member loyalty

2) Introduce the Member Engagement Matrix as a suggested method of evaluating credit union member engagement

3) Provide recommendations for credit unions going forward

Background

In the credit union industry, it was historically common for organizations to measure and track their member satisfaction scores to gauge member loyalty. Over time, as more options became available, credit unions expressed interest in the Net Promoter Score (NPS) to evaluate member loyalty and potential organizational growth. Ultimately, this was widely adopted for its simplicity and ease of use. Today, credit union executives continue to gravitate toward it also because it enables comparisons to credit union peers and to other industries. As discussed in the first paper in this series, member effort scores have grown in popularity over the past ten years, as organizations have looked for enhanced ways to measure customer loyalty. While all of these measures (member satisfaction, NPS, and member effort) offer insight to credit unions, research indicates that none on its own can offer a full picture of member engagement. To fully understand why this is, it is important to have background knowledge on relationship strength, types of loyalty, and on where each individual measure falls short in isolation.

Academic literature supports a definition of “relationship strength” that combines customers’ attitudes about an organization, customers’ behavior, and economic outcomes of the customer-organization relationship (Moore, Ratneshwar, & Moore, 2012). In order for a customer-organization relationship to be considered strong, a customer needs to both have positive feelings about the organization as well as engage in favorable behaviors with that organization, and there need to be positive economic outcomes resulting from the relationship. This balance of attitudinal and behavioral loyalty is important because if a customer has positive feelings about an organization but never engages in favorable behaviors, the organization will not make the money it needs to survive. Conversely, if a customer consistently engages in favorable behaviors, such as making a regular purchase, but does not have strong positive feelings about the organization, this may indicate that the customer is making that purchase purely out of habit or inertia. This is sometimes referred to as “spurious loyalty” (Dick & Basu, 1994, p. 101), and customers with this could be easily lost to a competitor when an affective bond is missing.

As mentioned earlier, credit unions historically measured member satisfaction to gauge loyalty, and some continue this practice today. While a member’s level of satisfaction can offer useful insights to a credit union, it is insufficient in isolation as an indication of that member’s overall loyalty or relationship strength given that it is based purely on the member’s attitudes. Research strongly indicates that satisfaction on its own does not necessarily lead to loyalty (Velázquez,, Saura, & Molina, 2011).

The NPS has become widespread in the credit union industry as a way to gauge member loyalty and potential organizational growth. While it, like member satisfaction, remains a useful tool for credit unions, it is widely cautioned that organizations should not use NPS alone as their only measure of loyalty or growth (Clark & Bryan, 2013; Zaki, Kandeil, Neely, & McColl-Kennedy, 2016). This is because, while NPS indicates a customer’s attitude toward an organization and his or her behavioral intentions, those intentions do not necessarily translate into actual behavior (Clark & Bryan, 2013; Zaki, et al., 2016).

Customer effort is another measure used by an increasing number of credit unions as a means to assess customer loyalty. Among other reasons, this is due to its more actionable nature than NPS. Effort, like satisfaction and NPS, indicates a customer’s attitude about an organization but also does a good job of predicting actual behavior such as levels of churn in an organization (Clark & Bryan, 2013). As it measures different things as satisfaction and NPS, though, it is ill advised to consider customer effort as a replacement for satisfaction and NPS (Clark & Bryan, 2013).

The consensus in the literature and among companies that strive to measure customer loyalty and relationship strength is to measure customer loyalty in multiple ways, as different metrics measure different things (Clark & Bryan, 2013). It is considered very risky to use and rely on just one measure of customer loyalty as opposed to taking a multidimensional approach (Zaki, et al., 2016).

Development of the Member Engagement Matrix

As discussed in the first paper in this series, Member Intelligence Group (MIG) developed the Net Effort Score (NES) in 2016. At the same time, taking into account the evidence suggesting that a multidimensional view of member loyalty is preferable to a single measure, MIG created the Member Engagement Matrix. This matrix incorporates both attitudinal and behavioral loyalty indicators, as well as measures of economic outcomes, and produces an overall measure of member engagement that a credit union can use to gauge the strength of its relationships with its members.

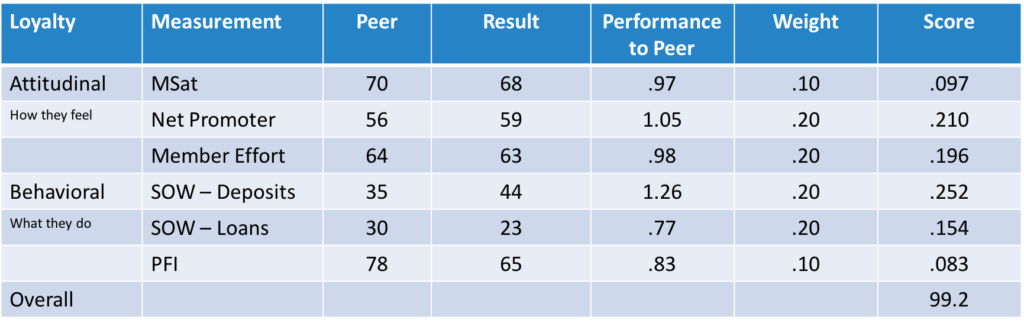

Below is an example of the matrix.

Member Engagement Matrix

As evident in the example above, the Member Engagement Matrix takes into account three measures of attitudinal loyalty: member satisfaction, NPS, and NES. Additionally, Preferred Financial Institution (PFI), determined by asking survey participants where they look first when in need of a new financial product or service, is included as a measure of behavioral loyalty. Finally, the matrix incorporates share of wallet for deposits and for loans as behavioral loyalty measures that represent economic outcomes. Each of these measures is compared to scores from peer institutions and given a performance score relative to peers. Next, those performance scores are weighted according to their relative importance as measures of engagement. These weights were determined through a combination of insights from academic literature and consultation with credit union leaders across the industry. The sum of the weighted scores produces an overall measure of member engagement. In the example above, the score of 99.2 would indicate that this institution is approximately equal to peer institutions in terms of its engagement with members, as a score of 100 is considered to be at peer. A number above 100 would indicate outperformance of peers, and a score below indicates the institution performs at a level below peers.

The overall member engagement score produced from the matrix provides a multidimensional view and a balanced method to determine members’ loyalty and the strength of their relationships with the credit union. Member Intelligence Group has calculated this score for dozens of credit union clients over the past several years in order to provide them with a more complete view of member engagement than any one measure alone can provide.

Recommendations

When thinking about strengthening relationships with members and tracking their engagement with their credit union, it is recommended that management consider the following:

- Utilize multiple measures to evaluate member engagement, and be sure to include measures that will offer views of attitudinal loyalty, behavioral loyalty, and economic outcomes. These three categories provide differing insights on members’ relationships with the organization. To use just one measure is risky (Zaki, et. al, 2016), as it greatly limits a credit union’s understanding of the strength of its relationship with its members.

- After collecting multiple measures, consider utilizing a matrix format, such as the Member Engagement Matrix, to organize and weigh the individual measures and ultimately calculate an overall score of member engagement. Doing this will preserve the value of taking multiple measures into account (and show where improvements are needed) yet still provide one overall member engagement score on which management and the Board of Directors can focus. This data should be refreshed at regular intervals so progress can be monitored and improvements can be made.

- Consider implementing a full Voice of the Member program that goes beyond quantitative survey research to also include qualitative work. While surveys provide valuable information and quantitative data on which credit unions can act, they can miss key insights that can be obtained only from asking members for deeper feedback. A truly comprehensive view of member engagement will be attained only with a blend of quantitative and qualitative research.

For more ideas on ways you can improve your members’ engagement with your organization, contact Katie Swanson at [email protected]. Please stay tuned for the third installment in the engagement white paper series, Beyond engagement and loyalty: Credit union brand love.

References

Clark, M., & Bryan, A. (2013). Customer effort: Help or hype? Henley Centre for Customer

Management, April, 1-22.

Dick, A. S., & Basu, K. (1994). Customer loyalty: Toward an integrated conceptual framework.

Journal of the Academy of Marketing Science, 22(2), 99-113.

Moore, M.L., Ratneshwar, S., & Moore, R.S. (2012). Understanding loyalty bonds and their

impact on relationship strength: A service firm perspective. Journal of Services Marketing, 26(4), 253-264.

Velázquez, B. M., Saura, I. G., & Molina, M. E. R. (2011). Conceptualizing and measuring

loyalty: Towards a conceptual model of tourist loyalty antecedents. Journal of Vacation Marketing, 17(1), 65-81.

Zaki, M., Kandeil, D., Neely, A., & McColl-Kennedy, J. R. (2016). The fallacy of the Net

Promoter Score: Customer loyalty predictive model. Cambridge Service Alliance,

October, 1-25.